what does cares act do

Please note that the above applies to federal taxes only. The Financial Aid Office encourages all students to submit the online form.

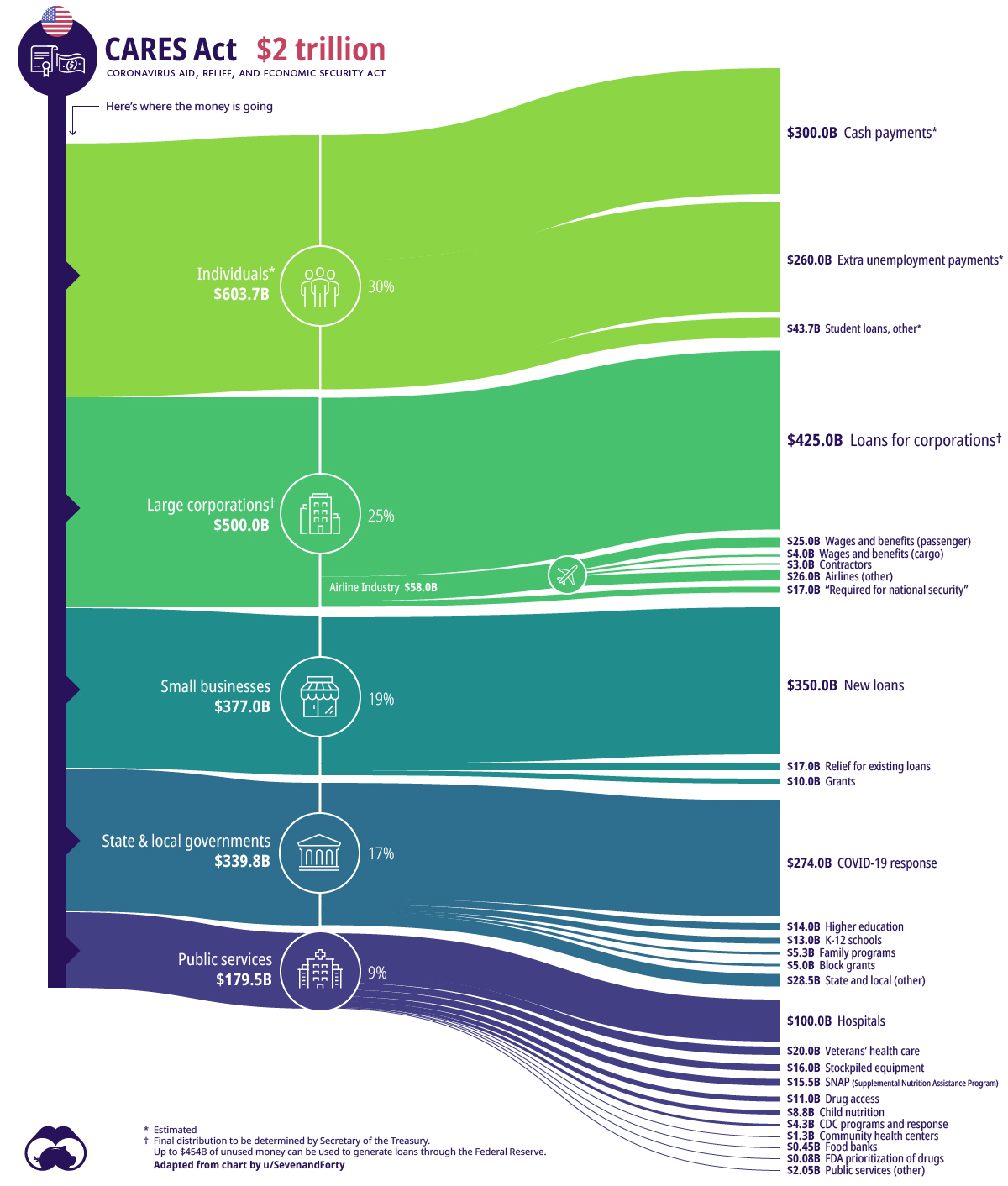

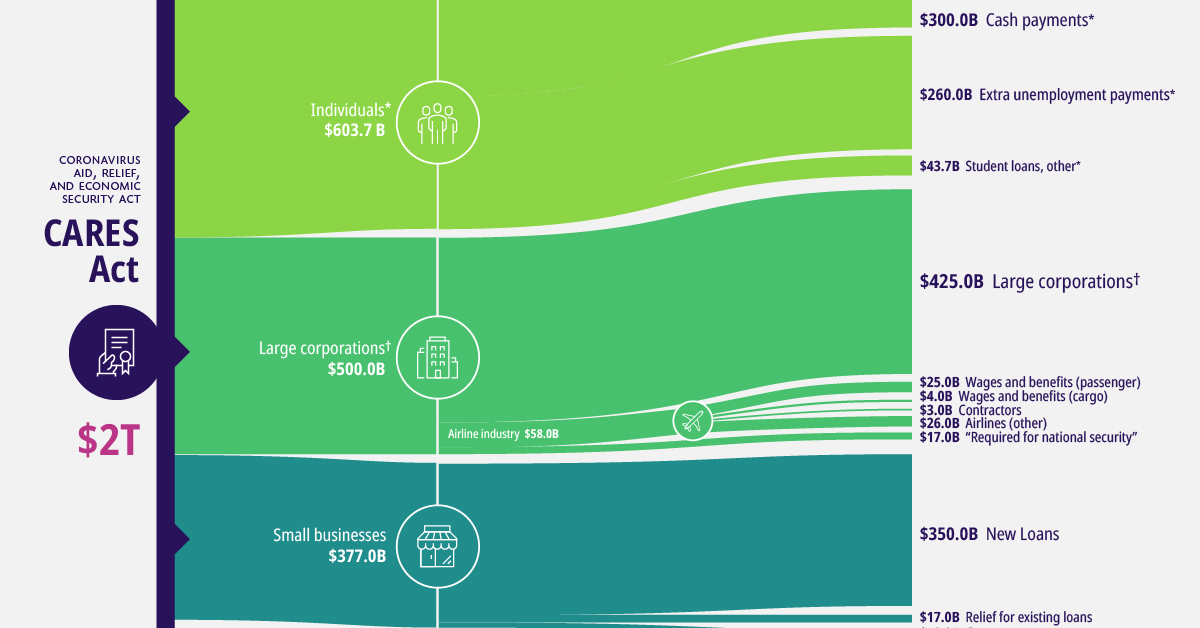

The Anatomy Of The 2 Trillion Covid 19 Stimulus Bill Visual Capitalist

Mortgage Payment Forbearance Request To.

. Also upon a borrowers request the forbearance must be extended for up to an additional 180 days. Once finalized the form has to be coded for electronic processing and tested. The IRS just started accepting returns today.

I understand that you can repay your 401K Cares Act withdrawal over the course of three years and recoup the taxes paid. My question is does that money need to go into the same 401K that it was withdrew from. Costs must not have been accounted for in the organizations most recently approved budget as of March 27 2020 and must be incurred between March 1 2020 and December 30 2020.

7 a loan program. This simple online form will only take a few minutes begin now. Distribution to Students Based on Credit Hours.

Students enrolled in 1-69 credit. Of that money approximately 14 billion was given to the Office of Postsecondary Education as the. Please visit wwwmyBenefitsnygov for more information and to apply.

A portion of each institutions. This bill allotted 22 trillion to provide fast and direct economic aid to the American people negatively impacted by the COVID-19 pandemic. This includes workers not otherwise eligible for.

Lumberjack CARES ActHEERF Grant. While the moratorium was set to expire on September 31st borrowers who hold federal student loans will now be interest and payment-free until January 31st 2022. On August 6th 2021 the Biden administration announced an extension to the CARES Act.

Funds will be distributed to students in a few ways. You do not need to submit proof of earnings such as a 1099 or tax filing at this time. CARES Act Withdrawals On March 27 2020 Congress passed the Coronavirus Aid Relief and Economic Security Act CARES Act to help those who have been financially impacted by the pandemic.

WIC Women Infants and Children Are you pregnant postpartum breastfeeding or have children under 5 and need help with. This is free grant money as part of the federal governments response to COVID. YVC has CARES Act funds available for students who have a valid FAFSAWASFA on file.

Students enrolled in the Winter 2022 semester may be eligible for Federal HEERF formerly CARES funds to help with expenses related to the ongoing COVID-19 pandemic. The Coronavirus Aid Relief and Economic Security Act or CARES Act was passed by Congress on March 27th 2020. The Higher Education Emergency Relief Fund III HEERF III is authorized by the American Rescue Plan ARP Public Law 117-2 signed into law on March 11 2021 providing support to institutions of higher education to serve students and ensure learning continues during the COVID-19 pandemic.

Federal COVID Relief Funds. This Act may be cited as the Coronavirus Aid Relief and Economic Security Act or the CARES Act. They are finalizing the forms now.

However they are not accepting returns with Form 8915-E included yet. The CARES Act makes the deduction limitation less restrictive for 2019 and 2020 in three ways. Skip your RMD for 2020.

The university distributed these funds during Summer 2021 and Fall 2021 and will do so again during the Spring 2022 semester. However if the borrower requests a forbearance. Of the CARES Act provides that the EIDL advance does not have to be repaid even if the loan is subsequently denied.

How do I claim a 1099-R from a Cares Act 401k withdrawal. The CARES Act does not however generally prohibit taxpayers from using an NOL from a tax year with a lower corporate tax rate eg 2020 to offset taxable income that was subject to a higher corporate tax rate in an earlier tax year eg 2017. GRANTS FROM LOCALITIES.

A borrower can at any time the borrower chooses shorten the forbearance and resume repayment of the loan. CARES Act borrowers are entitled to an initial forbearance period of up to 180 days upon a borrowers request. All costs must comply with any Guidance.

Northern Arizona University has received additional emergency relief aid from the Higher Education Emergency Relief Funds HEERF for student grants. Knowing that taxpayers take their RMDs at different times in the year the rules account for a few scenarios. The CARES Act suspension of the required minimum distribution from most retirement plans for 2020 does not appear to have been extended into 2021.

Federal CARES Act Funds. You should contact your plan provider or investment firm to make sure your Required Minimum Distribution is suspended for 2020 especially if you have. The CARES Act allows qualified individuals to withdraw money from an eligible workplace retirement plans such as a 401k or 403b.

Do you need help paying for food. The pause on federal student loan payments also referred to as the freeze has provided necessary relief. While the act bars landlords from charging late fees and other penalties because of a tenants nonpayment during the 120 days whether or not late fees and interest on rental payments are prohibited from accruing during the grace period and being.

What does the RMD change in the CARES Act allow. I have since my withdrawal rolled over that account into another 401K and no longer have the account I originally withdrew the money from. I do not see an option to spread it over three years as the IRS site claims.

SNAP benefits can help you put healthy food on the table. How does the CARES Act affect 163j. You have the option to have funds applied to tuition charges or sent.

For more information about how the extension of these CARES Act provisions may impact your specific financial situation please consult with your. The CARES Act does not address how landlords can respond to missed payments after the moratorium ends. Nonqualified and 457f plans are not.

Guidance for Assisting Borrowers If a borrower can still make their mortgage payment request that they continue to do so. The CARES Act provides a mortgage payment forbearance option for all borrowers who either directly or indirectly suffer a financial hardship due to the novel coronavirus COVID-19 national emergency. PUA provides up to 39 weeks of unemployment benefits to people who are able and available for work within the meaning of applicable Arizona state statute although they are unemployed partially unemployed or unable to work due to one of the COVID-19 related reasons identified in the CARES Act Section 2102a3AiiI.

A provision within the CARES Act is the Pandemic Unemployment Assistance PUA program. DIVISION ASMALL BUSINESS INTERRUPTION LOANS. The Federal programs provided by the CARES Act have expired.

Many commentators have noted that the CARES Act is better characterized as a relief bill which addresses the more immediate. CARES Act funding can only be used to pay for costs of necessary expenditures incurred due to the COVID-19 public health emergency. State law may vary.

The deduction limit is raised from 30 of ATI to 50 for tax years 2019 and 2020 for all taxpayers except for partnerships. The largest emergency response bill in history the CARES Act allocates nearly 2 trillion in emergency funding to provide relief to households small and large businesses states and municipalities and healthcare providers among others. HEERF III What Is It.

The Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 is designed to encourage Eligible Employers to keep employees on their payroll despite experiencing economic hardship related to COVID-19 with an employee retention tax credit Employee Retention Credit. It will provide unemployment insurance benefits to those who are not covered by the regulartraditional Virginia state UI program. Moreover before claiming an NOL carryback for a prior tax corporate taxpayers may also want to consider how other tax.

Taxpayers may elect not to apply the 50 limitation to either 2019 or 2020 if they choose. The table of contents for this Act is as follows. Because the advance never has to be repaid ie there are no conditions that have to be met to have the advance on the loan forgiven or discharged the department will treat the advance as a grant which is not subject to tax.

Specifically you can choose to.

Cares Act Emergency Assistance University Of Texas At Austin

How Much Covid Relief Money Is Left Committee For A Responsible Federal Budget

Msu Health Care Covid 19 Testing Health Care Michigan State University

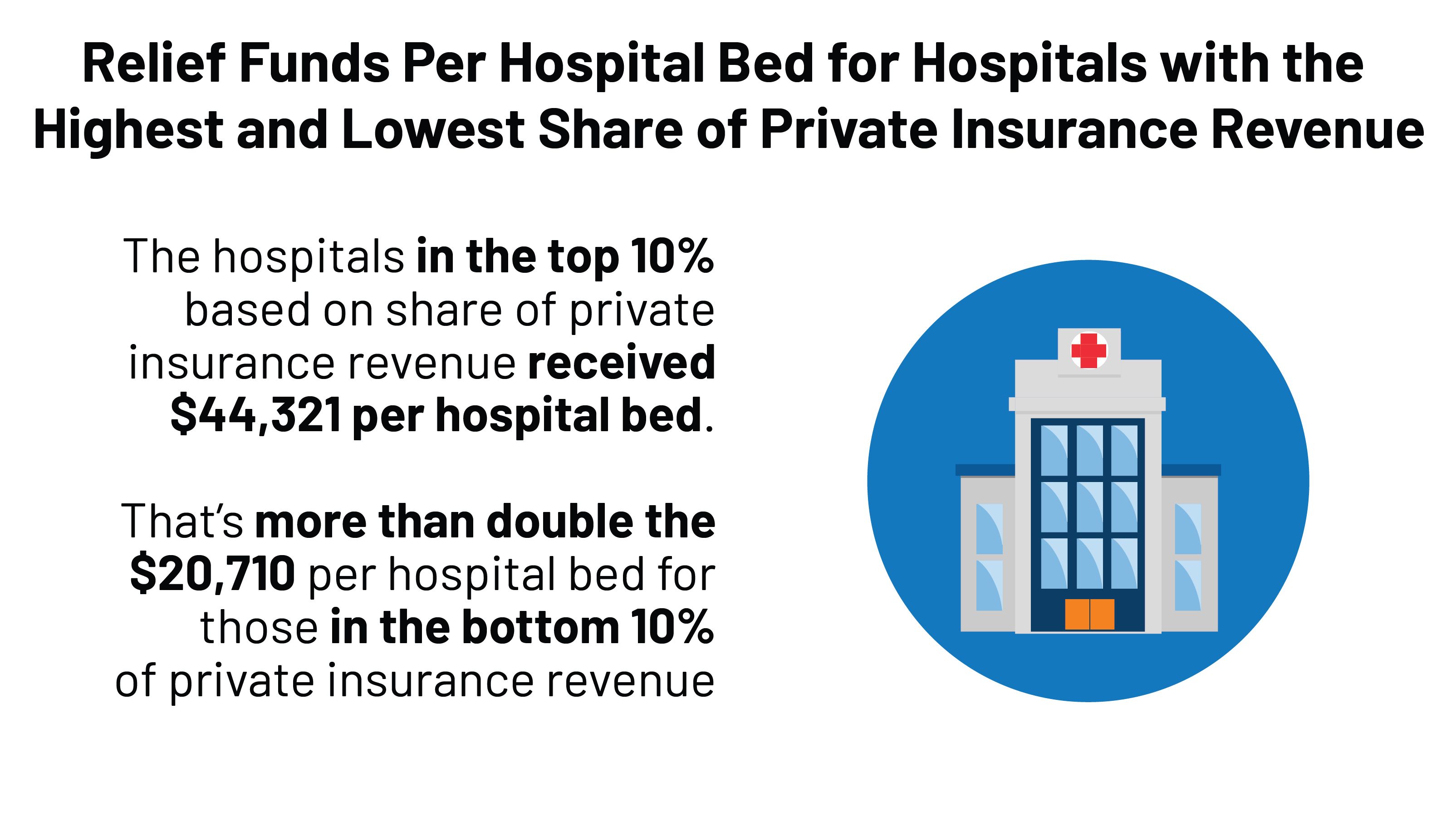

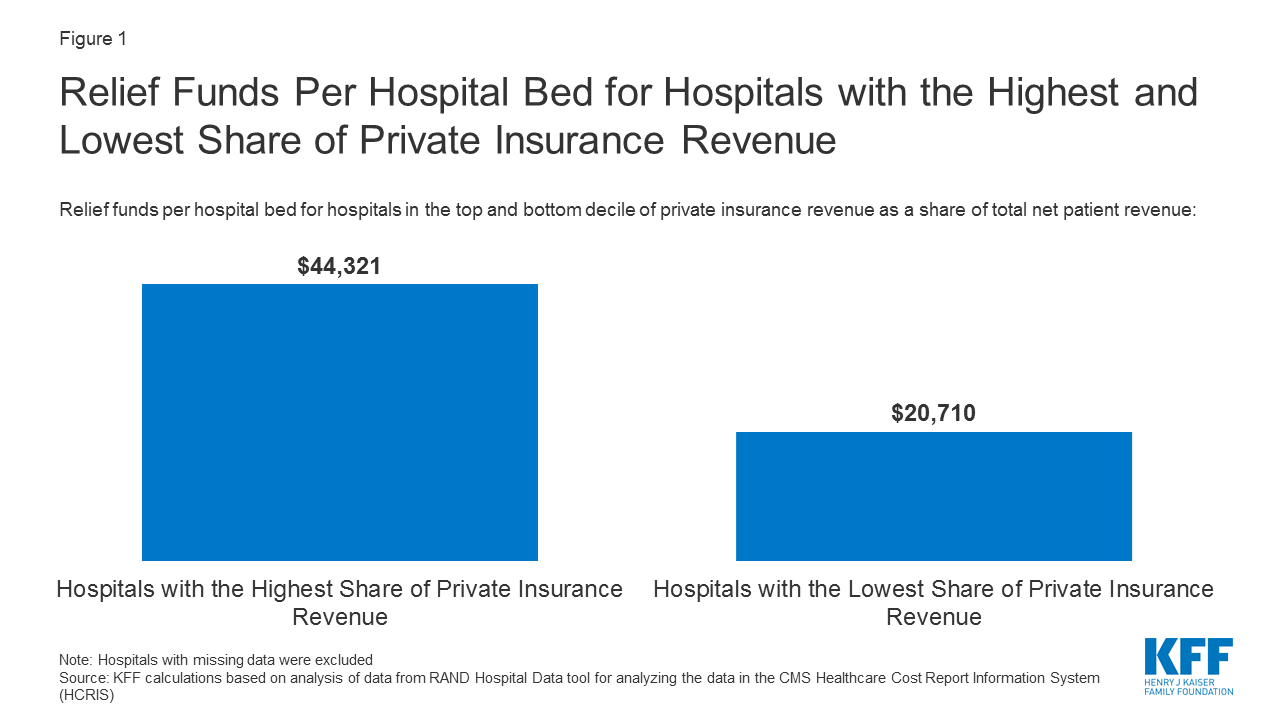

Distribution Of Cares Act Funding Among Hospitals Kff

Cares Act Investment New Jersey State Library

Understanding The 1 Trillion In Unspent Covid Relief Funding Committee For A Responsible Federal Budget

Key Economic Findings About Covid 19 Bfi

Details Of The Coronavirus Relief Bill The Cares Act Npr

The Coronavirus Aid Relief And Economic Security Act Summary Of Key Health Provisions Kff

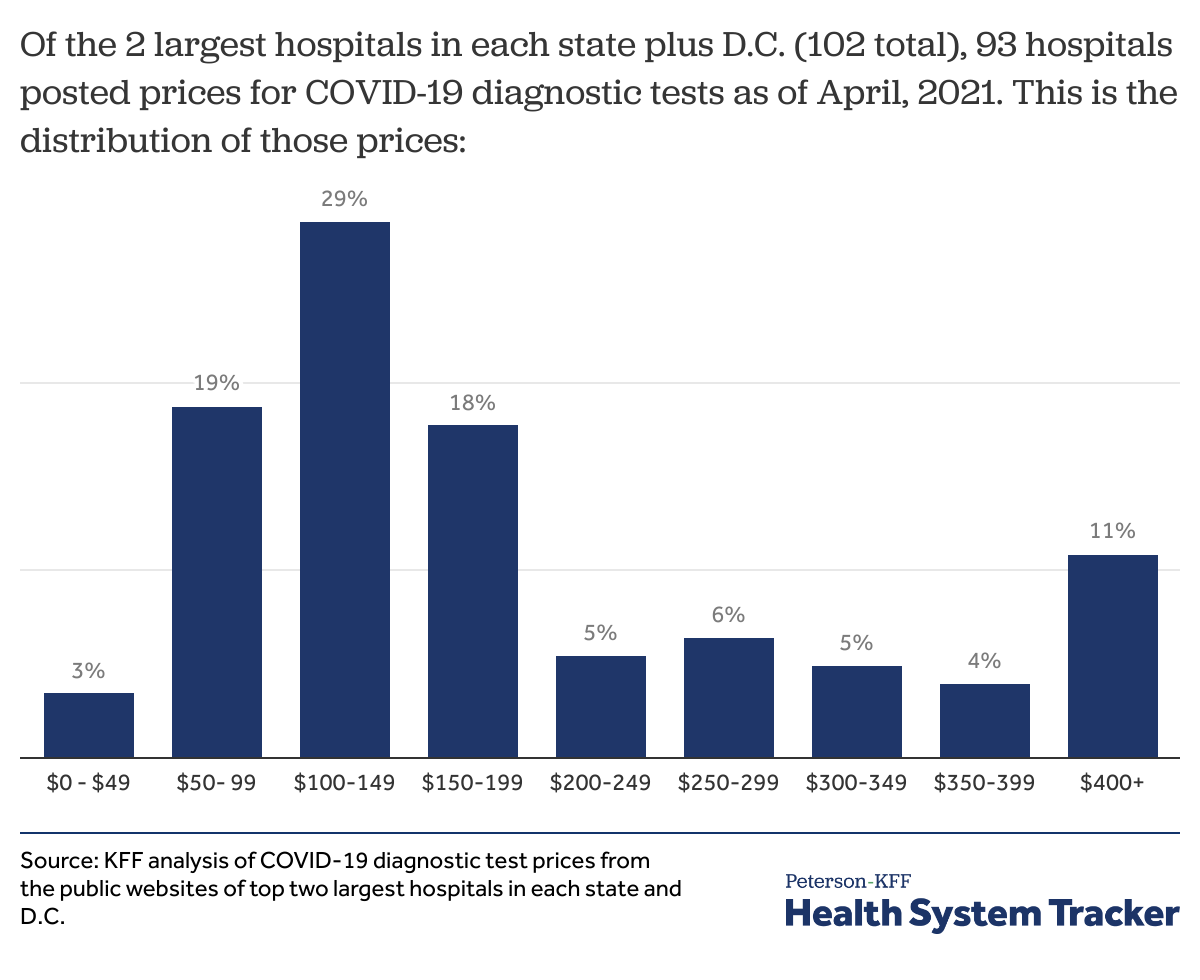

Covid 19 Test Prices And Payment Policy Peterson Kff Health System Tracker

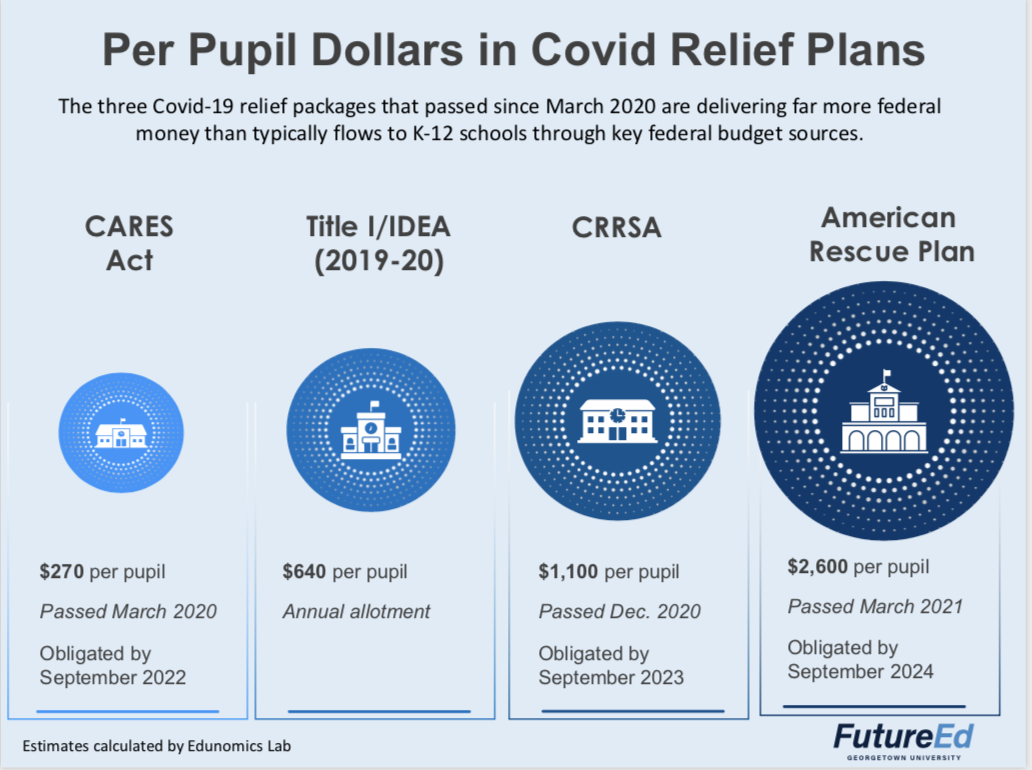

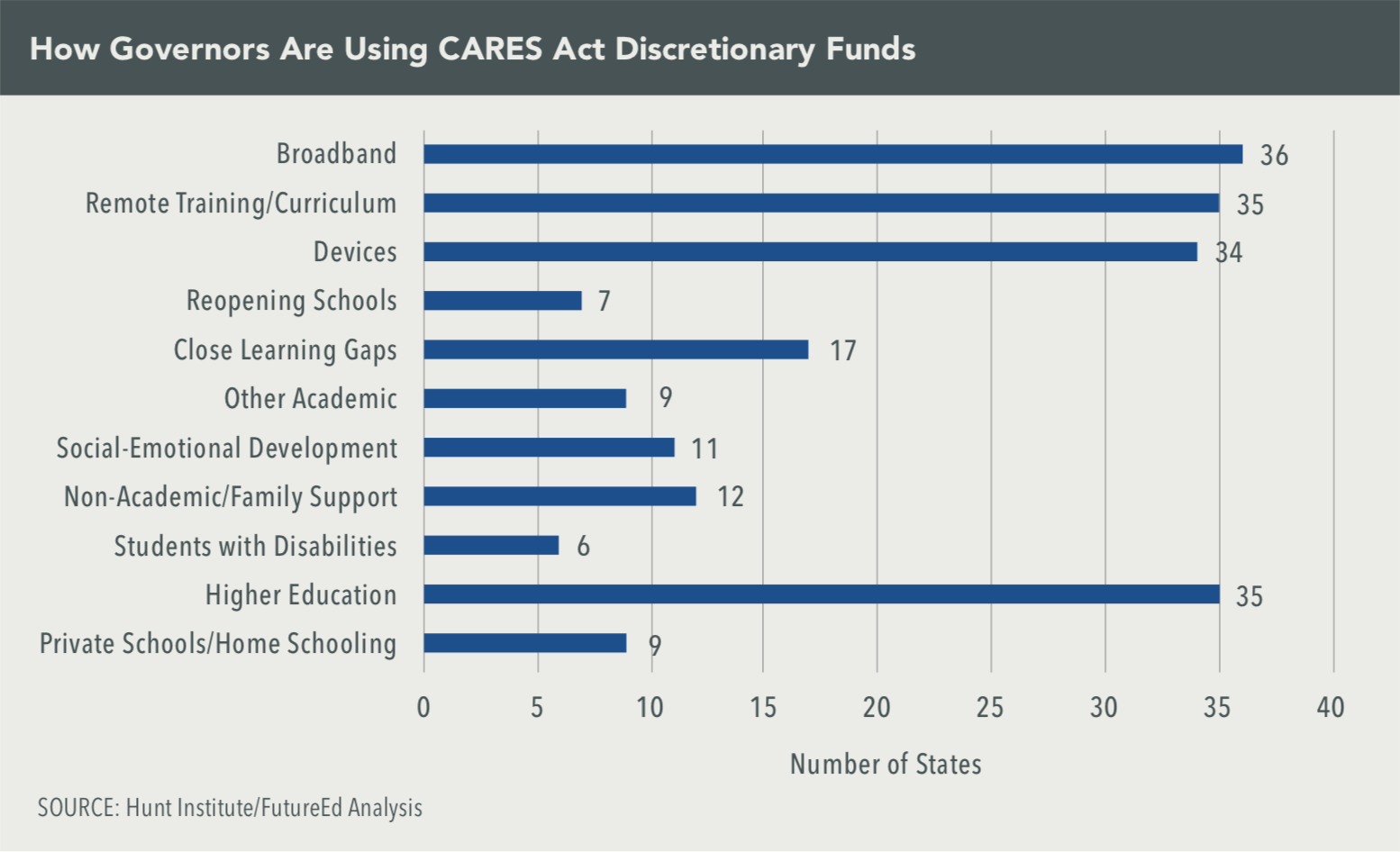

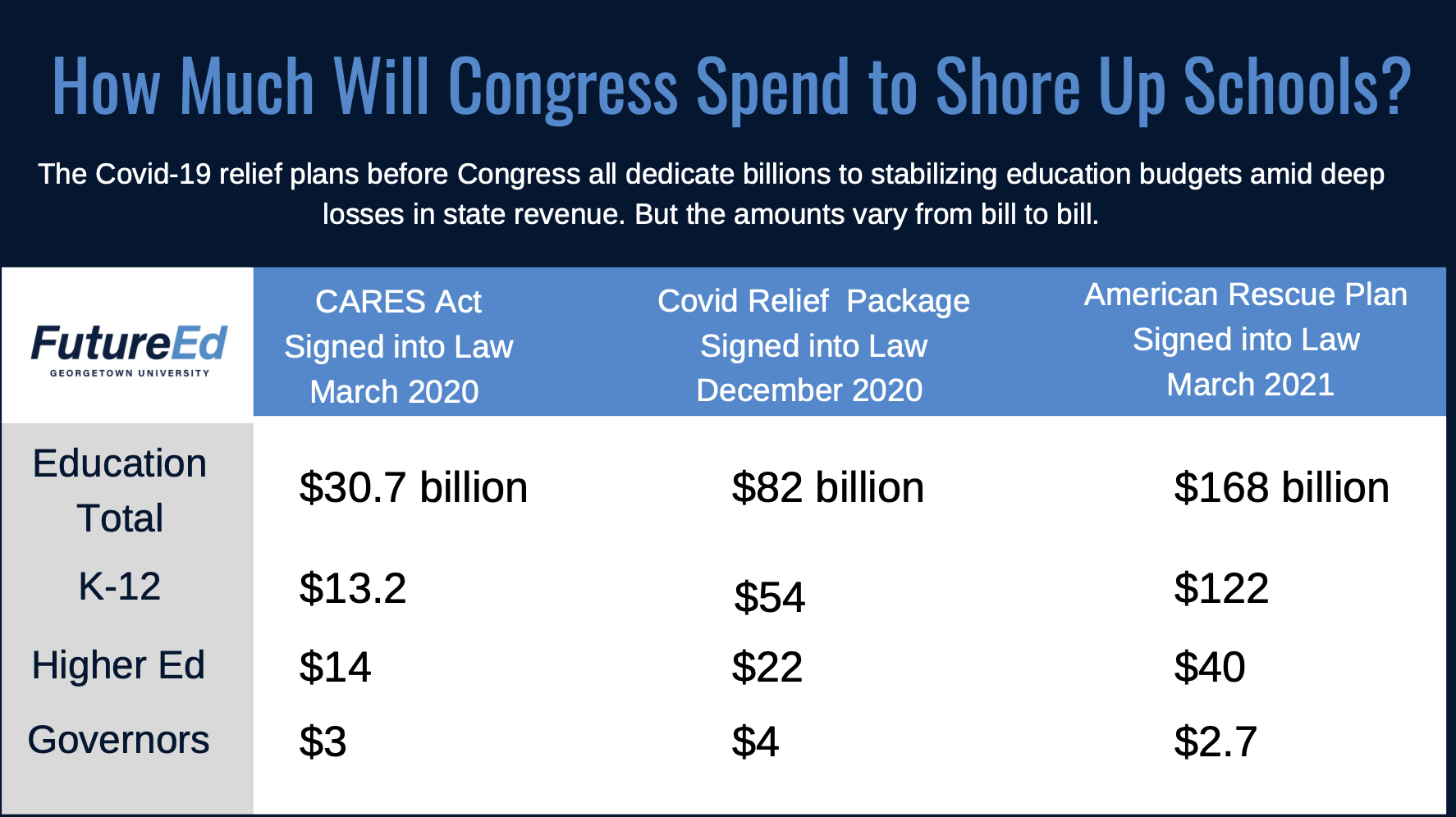

What Congressional Funding Means For K 12 Schools Futureed

What Congressional Funding Means For K 12 Schools Futureed

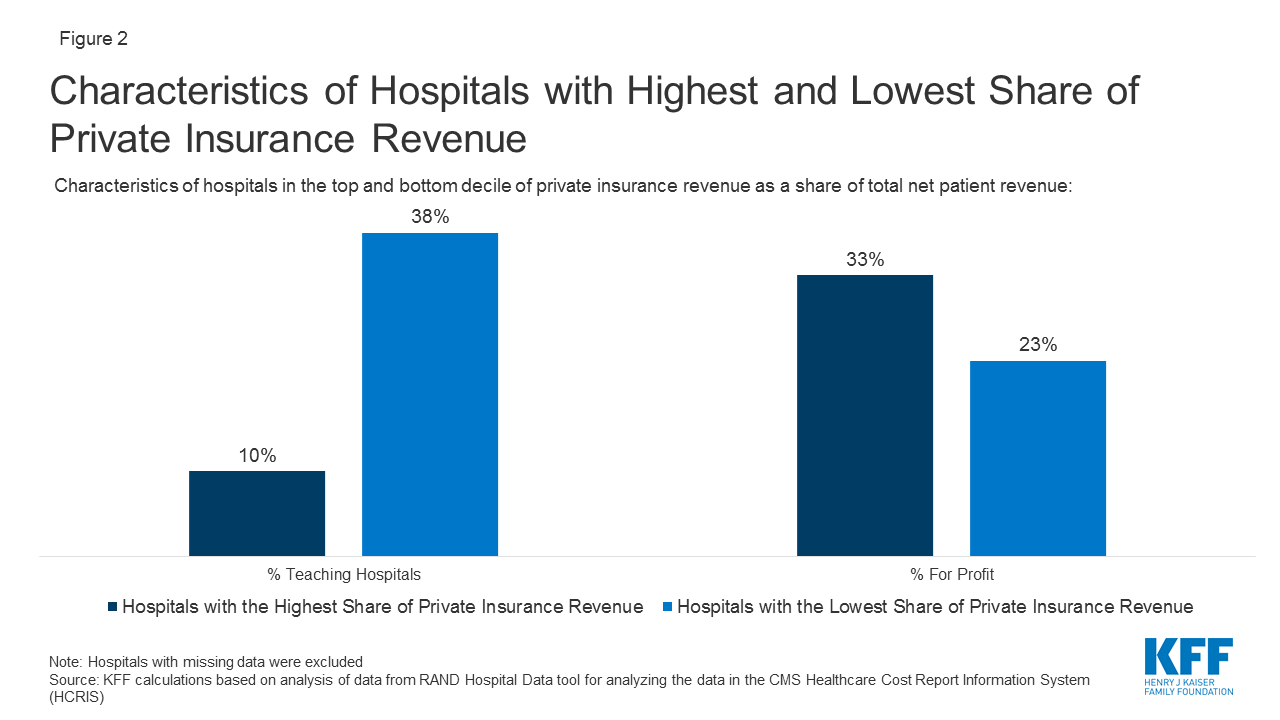

Distribution Of Cares Act Funding Among Hospitals Kff

Cares Act Faq Municode Powered By Civicplus

How Has The Us Coronavirus Aid Package Affected Household Spending

Distribution Of Cares Act Funding Among Hospitals Kff

The Families First Coronavirus Response Act Summary Of Key Provisions Kff

What Congressional Funding Means For K 12 Schools Futureed

The Anatomy Of The 2 Trillion Covid 19 Stimulus Bill Visual Capitalist