how to pay late excise tax online

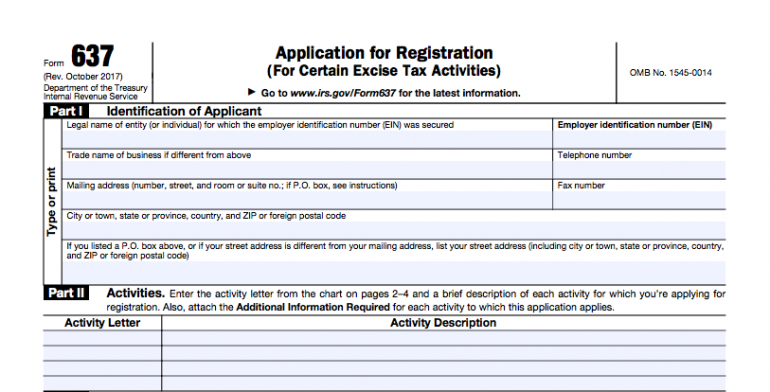

Once you enter your NAME please CLICK one of the options below to continue entering specific information. Internal Revenue Code 4121 imposes an excise tax on coal from mines located in the United States sold by the producer.

Online Payments Watertown Ma Official Website

If Half-yearly Service Tax Return ST-3 ST-3A is filed after the due date of return filing then the assessee is required to deposit late fees depending upon the period of delay.

. Item 1 - Serial Number. A nontaxable delinquent excise tax return has 0 liability. If your excise tax payment is late you must pay additional penalties and interest based on the amount of taxes you owe.

Complete the Form BB-1 State of Hawaii Basic Business Application BB-1 Packet and pay a one-time 20 registration fee. Excise Tax on Coal. If you wish to use the pay-by-phone service please call toll-free.

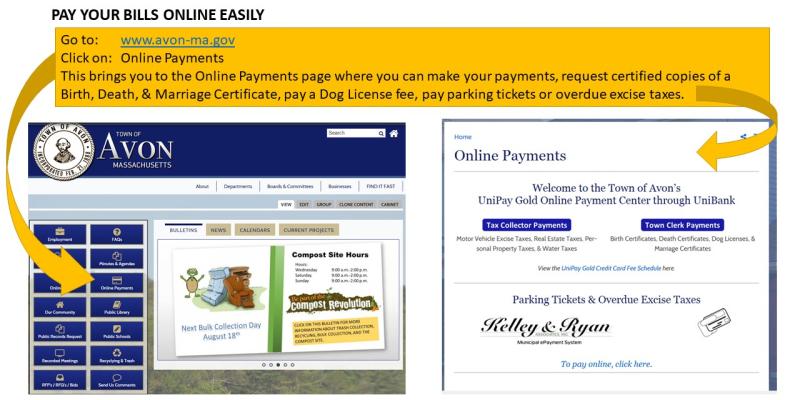

You must create a serial number in this format. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. You must have Signing.

In 2017 the excise tax rate on spirits containing more than 7 ABV rate per liter of. Item 1 - Serial Number. The excise tax is deposited in the Black.

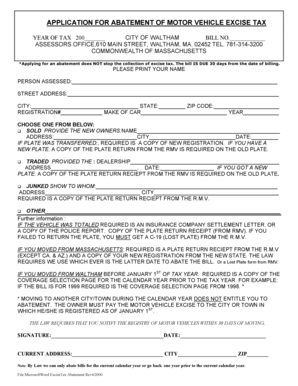

Use our penalty and interest calculator to determine late filing and late payment penalties and interest. When you fail to pay a motor vehicle excise a tax collector can collect the delinquent excise by placing marking your vehicle registration and operating license in non. Pay income tax through Online Services regardless of how you file your return.

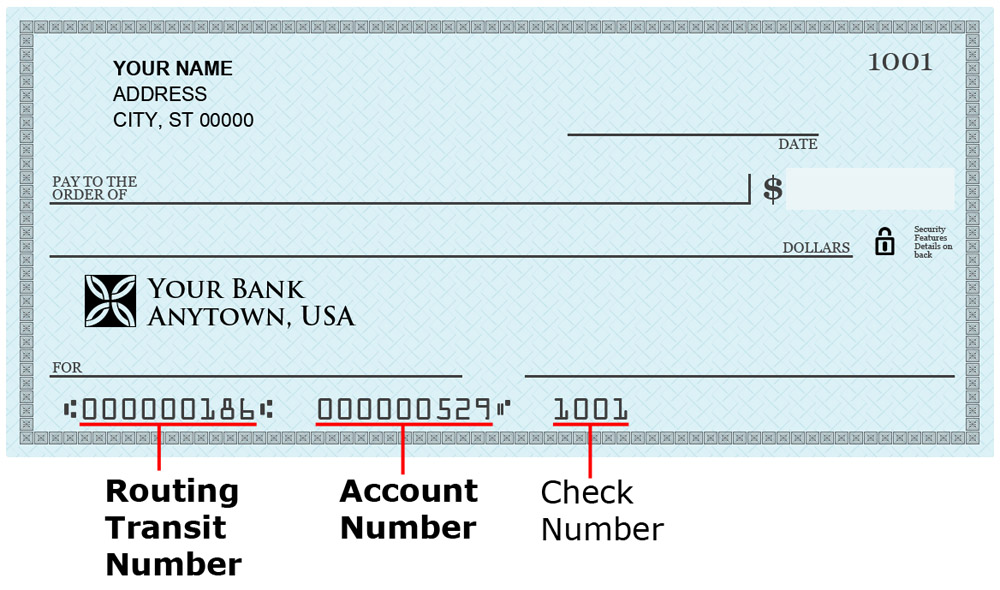

Paying excise duty on excisable alcohol. Excise tax rates on distilled spirits in Canada have been steadily increasing for the past four years. Please have a check not a deposit slip in hand with your bank information routing number etc and your email address.

Go to our online system. 2000-01 for PERIOD returns and in this format P-2001-001 for PREPAYMENT returns. Pay your outstanding obligations online by clicking on the Green area on the home page.

Tax Department Call DOR Contact Tax Department at 617 887-6367 Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089 9 am4 pm Monday. How To Pay Late Excise Tax Online. You can file and pay your returns electronically with Paygov TTBGov - Epayment.

To pay BBMP property tax online you need to follow the steps mentioned below. Please have a check not a deposit slip in hand with your bank information routing number etc and your email address. Pay-By-Phone Option The service fees for pay-by phone are the same as indicated above for paying online.

After receiving your bill you should fill out the. Paying excise duty on excisable alcohol. It is filed administratively by IRS for a specific taxpayer to establish the tax period in order to make an assessment.

You need to enter your last name and license plate number to find your bill. Request for Tax Information. All owners of motor vehicles must pay an excise tax.

Excise tax return extensions. Payment by credit card or electronic check may be made over the phone by. Additional fees may apply depending on which tax.

Once completed click the NEXT button within the option you choose. How To Pay Late Excise Tax Online. You can pay your excise tax through our online payment system.

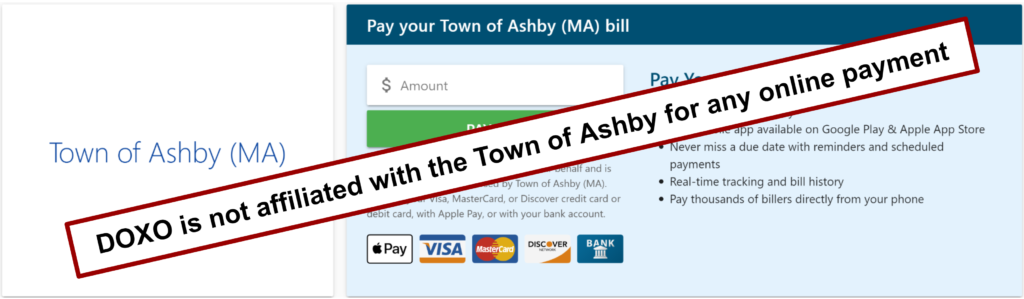

For your convenience payment can be made online through their website. Late-filing penalties can mount up at a rate of 5 of the amount due with your return for each month that youre late. In this example 2000 is the.

Excise tax return extensions. Therefore it is the responsibility of the owner to contact the Tax Collectors Office if. Generally if you hold an excise licence you need to lodge an excise return and pay excise duty before you deliver excisable products into the.

Indiana Sales Tax On Cars What Should I Pay Indy Auto Man Indianapolis

Uganda Revenue Authority Ura Urapublicnotice Update On Ura Business Continuity Measures In Place To Support The Taxpayer Amid The Covid 19 Global Pandemic Read Notice For Details On Return Filing Extensions Installment

Treasurer Collector Town Of Montague Ma

Frequently Asked Questions Faq King County

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

How To Make A Payment Seekonk Ma

Motor Vehicle Excise Tax Bills Gardner Ma

Tax Collector Tax Payment City Of Holyoke

Fillable Online Application For Abatement Of Motor Vehicle Excise Tax Fax Email Print Pdffiller

3 11 23 Excise Tax Returns Internal Revenue Service

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

City Of Hartford Tax Bills Search Pay

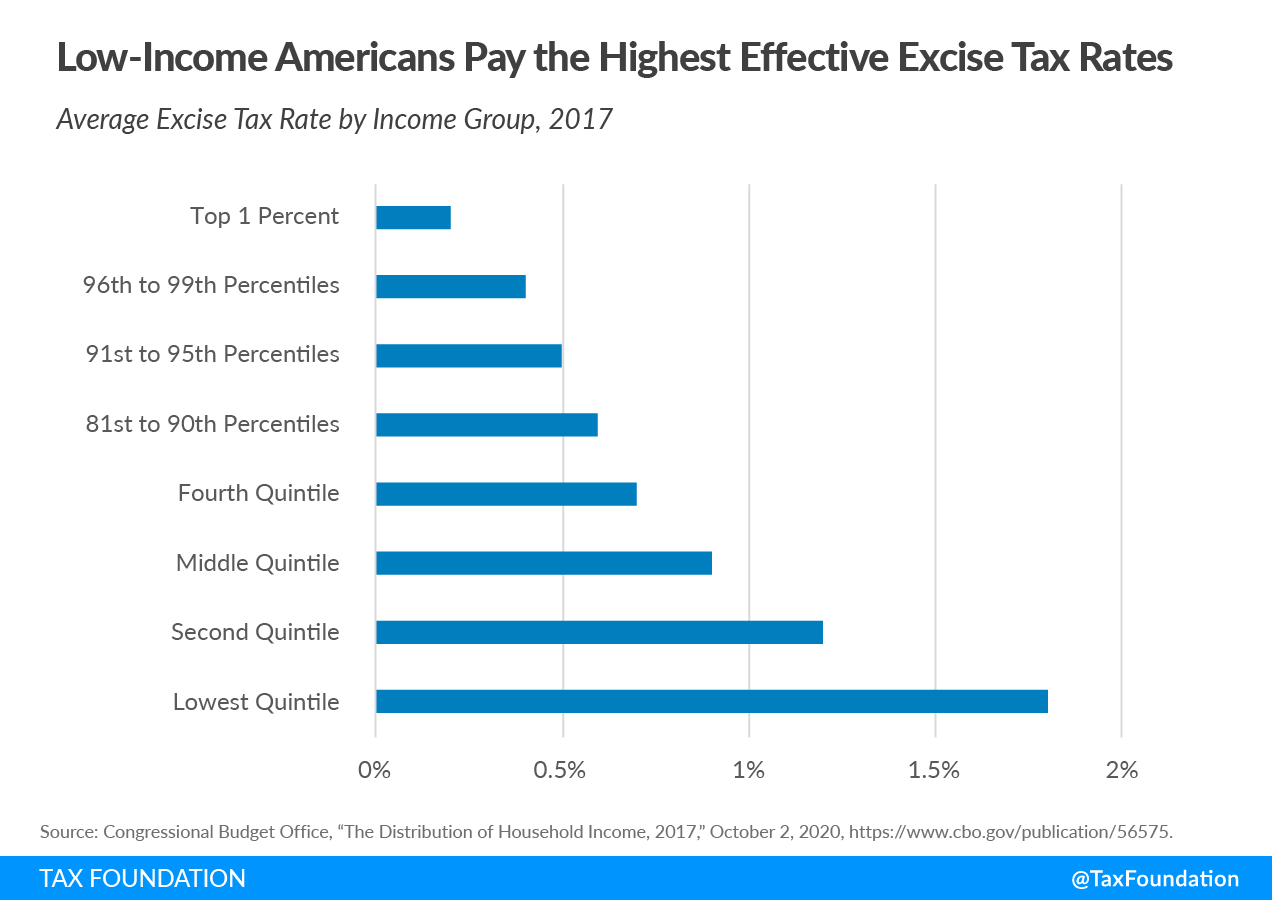

Excise Taxes Excise Tax Trends Tax Foundation